Smart Capital for Real Estate Investors

DSCR loans designed for investors. Qualify based on rental income, not your personal finances. Scale your portfolio without income caps.

About USA Mortgages

Smart Financing Solutions for Real Estate Investors

USA Mortgages provides smart financing solutions for real estate investors across the United States. We offer DSCR loans and other flexible financing options—focused on property cash flow, not traditional income hurdles.

┃ "Our mission is simple: Deliver smart capital that helps investors build long-term wealth."

Our Loan Products

Financing Solutions for Every Investment Strategy

Whether you're flipping properties, building a rental portfolio, or scaling your investments, we have the right loan product for your needs.

Fix & Flip

Bridge Loans

Loan Amount

Min: $50,000

Max: $3,000,000

Term Length

12 months, up to 18 at lender discretion

Max LTC

Up to 90% of purchase price

Up to 100% of rehab costs

Max Loan to ARV

Up to 75%

FICO

620 Min

Loans < 680 FICO are subject to stricter underwriting guidelines and additional IR

Experience

All levels considered (leverage based on experience)

Single Property Rental

Term Loans

Loan Amount

Min: $75,000

Max: $2,000,000

Property Types

Single Family Residences (SFR)

2-4 unit properties

Warrantable condos

Townhomes

PUD

Term Length

30 Years

Various Prepay Penalty Options

Loan Types

Fixed rate and Adjustable rate options available

Partial IO and Fully Amortizing options available

Max LTC

If owned < 3 months, 80% of Total Cost Basis

Max Loan to ARV

Up to 80% on Purchase, Rate & Term Refinance

Up to 75% on Cash Out

Experience

Not Required

FICO

660 Minimum

Recourse

Full Recourse only

Lease Requirements

Leased Units: Lower of (i) In-Place Rent & (ii) Market Rent

Unleased Units: 100% of market rent on purchase. On a refinance, 1 unit of a 2-4 unit can be vacant

Rental Portfolios

Term Loans

Loan Amount

Min: $72,000

Max: $2,000,000

Property Types

Non-Owner Occupied

Single Family Residences (SFR)

2-4 unit properties

Warrantable condos

Townhomes

PUD

Term Length

30 Years

Various Prepay Penalty Options

Loan Types

Fixed rate and Adjustable rate options available

Partial IO and Fully Amortizing options available

Max LTC

If owned < 3 months, 80% of Total Cost Basis

Max Loan to ARV

Up to 80% on Purchase, Rate & Term Refinance

Up to 75% on Cash Out

FICO

660 Minimum

Recourse

Full Recourse with Pledge of Equity of Borrowing Entity

Non Recourse options available with Bad-Boy Carveouts

Lease Requirements

Minimum Occupancy Rate of 100% by Unit Count

Leased Units: Lower of (i) In-Place Rent & (ii) Market Rent

Unleased Units: 100% of Market Rent (Purchase Loans only)

Not sure which product is right for you? Our team can help you find the perfect fit.

What is a DSCR Loan?

Qualify Based on Rental Income, Not W-2s

A Debt Service Coverage Ratio (DSCR) loan qualifies borrowers based on the rental income of the property, rather than W-2s, tax returns, or personal debt-to-income ratios.

How It Works

Fast. Simple. Investor-Focused.

Our streamlined process gets you from application to closing quickly and efficiently.

Lending Locations

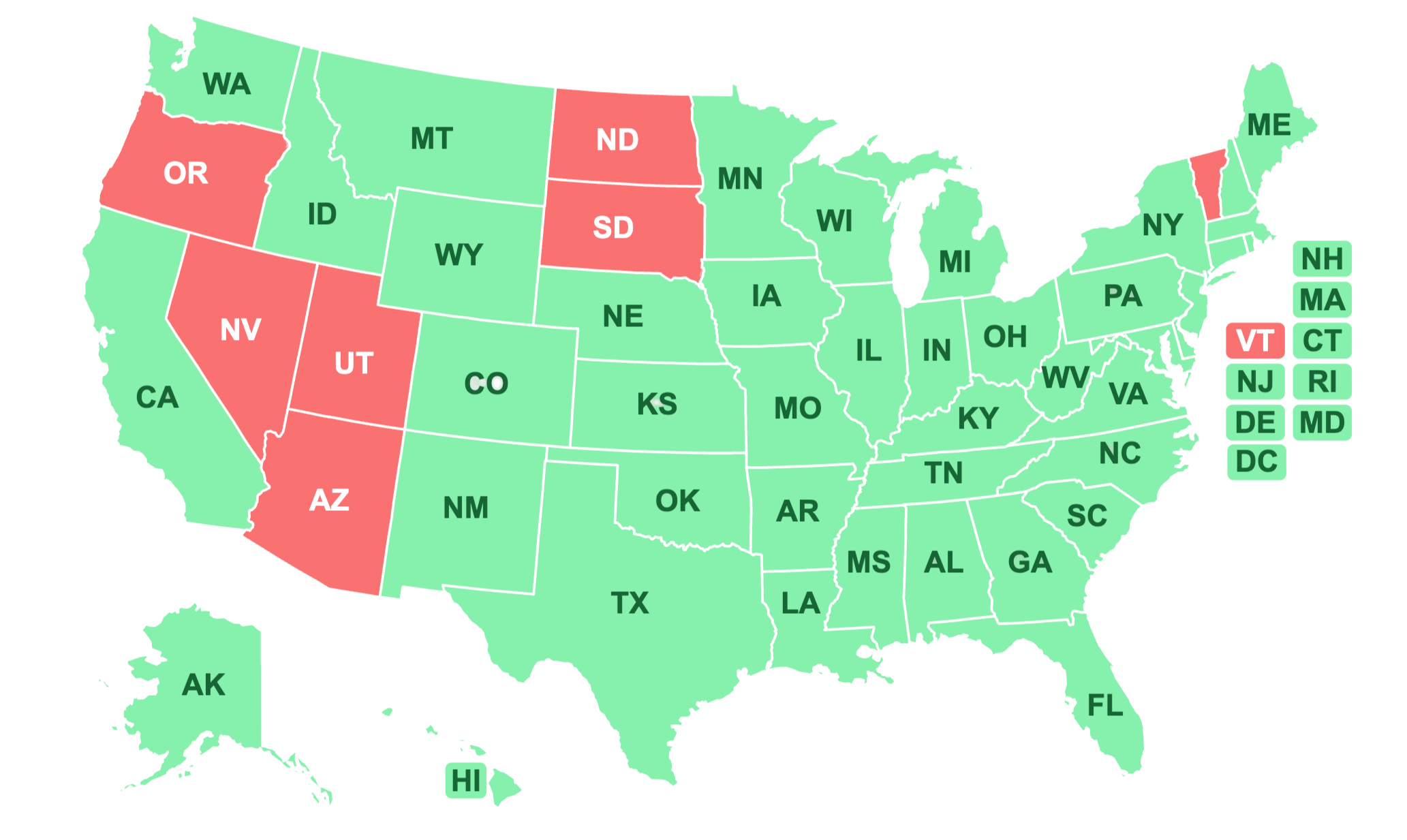

Nationwide Coverage

We provide DSCR loans across most of the United States. Hover over the map to see availability in your state.

Currently not lending in: Arizona, Nevada, North Dakota, Oregon, South Dakota, Utah, Vermont

Partner Program

Refer Investors. Get Rewarded.

The USA Mortgages Partner Program allows professionals to earn by referring real estate investors seeking DSCR and investment property loans.

You refer the client. We handle the financing.

Who Can Join

How It Works

Apply Now:

Complete the form below to apply. Our team will review your application and contact you shortly.

Program subject to approval and compliance guidelines.

Contact Us

We're Here to Help

Have questions about DSCR loans or our lending process? Our team of investment loan specialists is ready to assist you.

Get Started

Get a Quote Today

Ready to scale your real estate portfolio? Fill out the form and our team will contact you to discuss your financing options.

USA Mortgages provides smart financing solutions for real estate investors across the United States. DSCR loans and flexible financing options focused on property cash flow.

© 2026 USA Mortgages. All rights reserved.